nh food tax rate

The state does tax income from interest and. All documents have been saved in Portable Document Format unless otherwise.

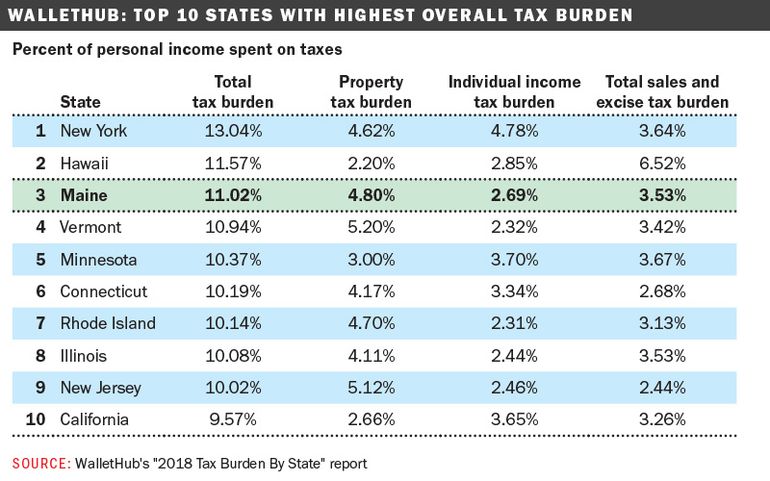

States With The Highest Lowest Tax Rates

Gail Stout 603 673-6041 ext.

. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. Some rates might be different in Portsmouth. The state does tax income from interest and.

The New Hampshire income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9. Employers can view their current and prior.

Year Rate Assessed Ratio. I ncorporated in 1794 the Town of Brookfield New Hampshire is located in Carroll County. The local tax rate where the property is situated.

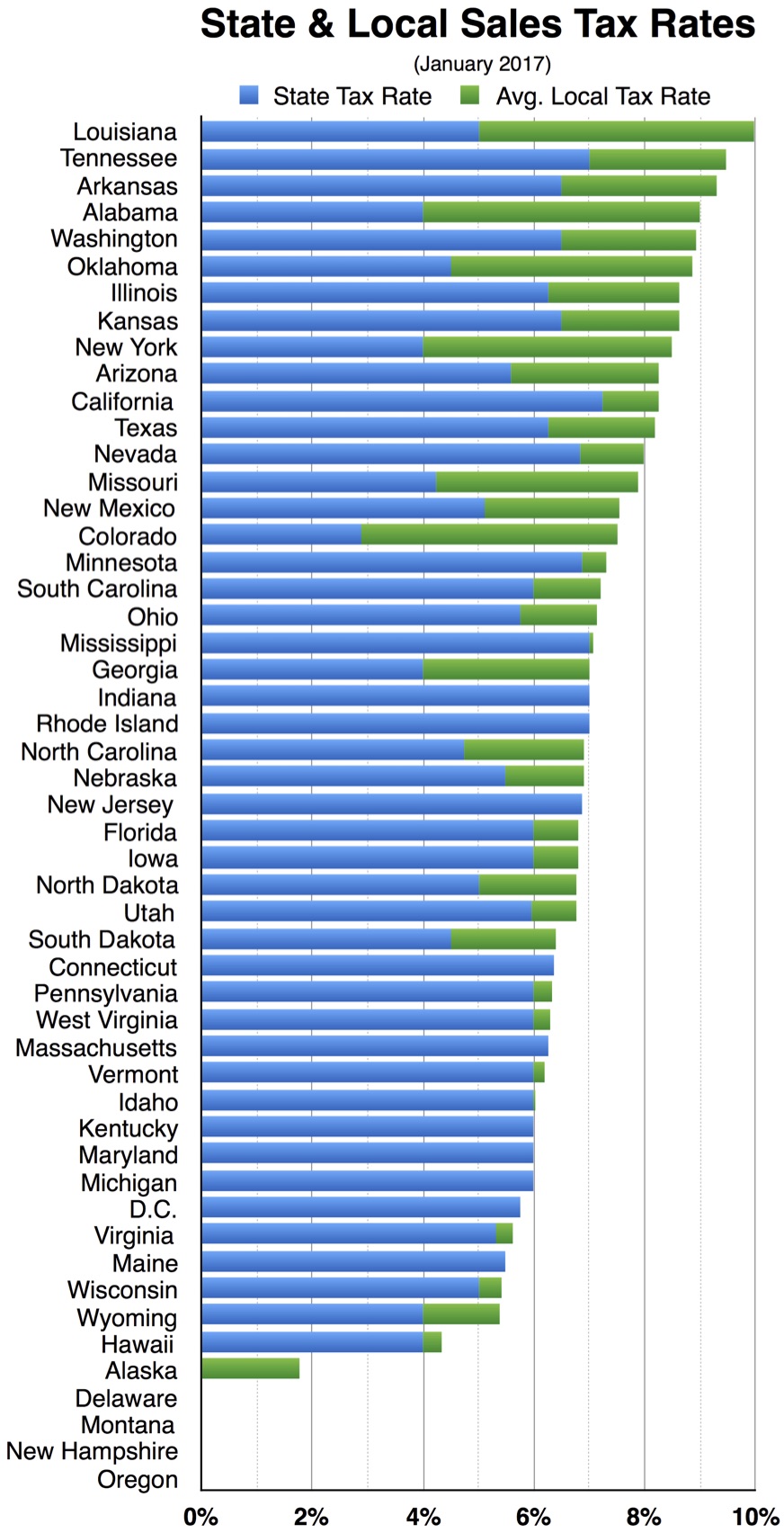

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. The assessed value of the property. New Hampshire Towns with the Highest Property Tax Rates.

Prepared Food is subject to special sales tax rates under New. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. A 9 tax is also assessed on motor vehicle rentals.

Municipal reports prior to 2009 are available by request by calling the department at 603 230-5090. Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85. A 9 tax is also assessed on motor.

New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0. Nh Food Tax Calculator.

Property tax bills in New Hampshire are determined using factors. Prepared Food is subject to special sales tax rates under New Hampshire law. Claremont has a property tax rate of 4098.

That is a decrease of 029 or 16. Town of Amherst 2 Main. Detailed New Hampshire state income tax rates and brackets are.

2022 Tax Rate Set. New hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. New Hampshire Sales Tax Rate 2021.

A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. Exact tax amount may vary for different items. 45 rows Annual Tax Rate Determination Letters mailed by September 2 2022 for the tax period 712022 Q32022 through 6302023 Q22023.

The new hampshire state sales tax rate is 0 and the average nh sales tax after local surtaxes is 0. Concord NH The New. New Hampshires sales tax rates for commonly exempted categories are listed below.

For example the owner of a home. For additional assistance please call the Department of Revenue Administration at 603. The New Hampshire sales tax rate is 0 as of 2022 and no local sales tax is collected in addition to the NH state tax.

Nh Food Tax Calculator. Below are the 10 towns in New Hampshire with the highest property tax rates.

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

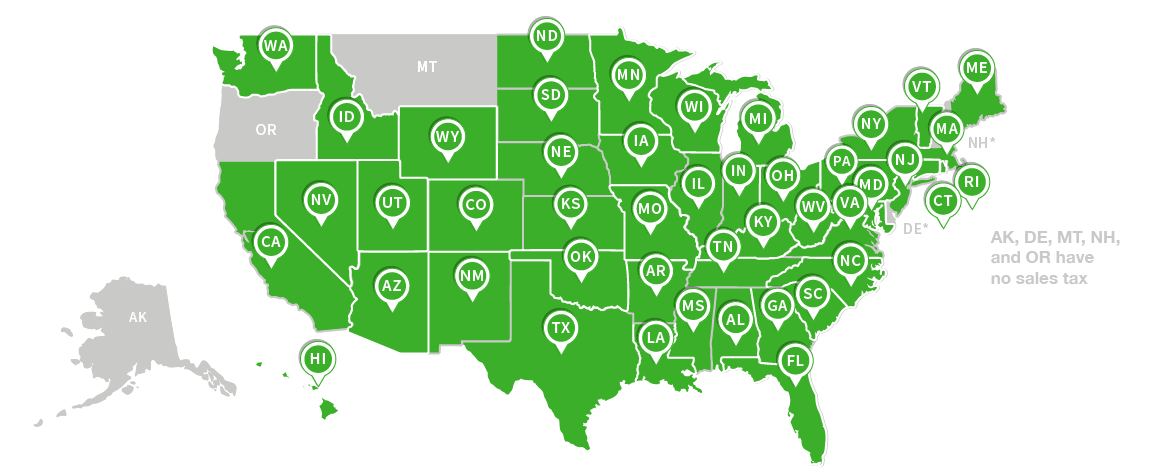

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

Tax Collector Town Of Nottingham Nh

What Kind Of Taxes Will You Owe On New Hampshire Business Income Appletree Business

New Hampshire Sales Tax Rate 2022

Maine Makes Top 5 In States With Highest Tax Burden Mainebiz Biz

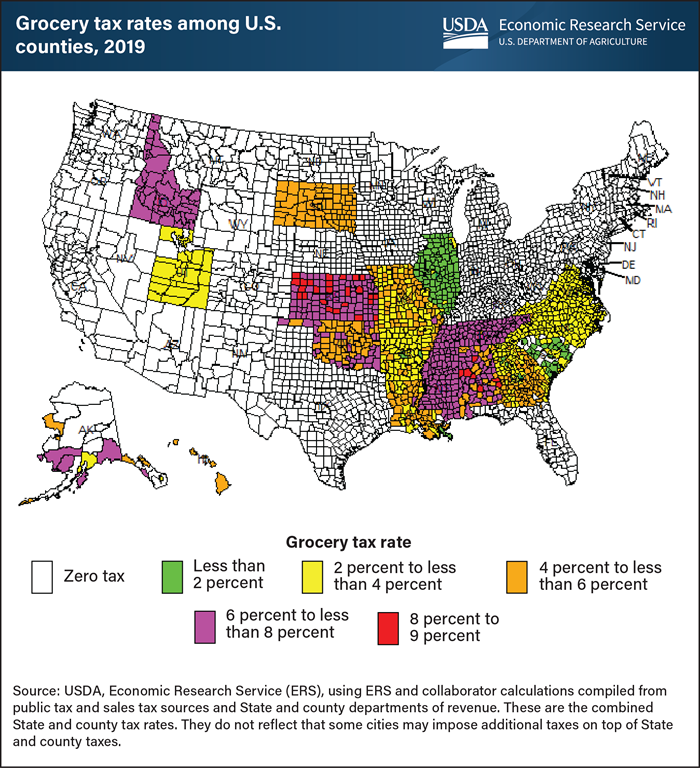

Pdf Do Grocery Food Sales Taxes Cause Food Insecurity Semantic Scholar

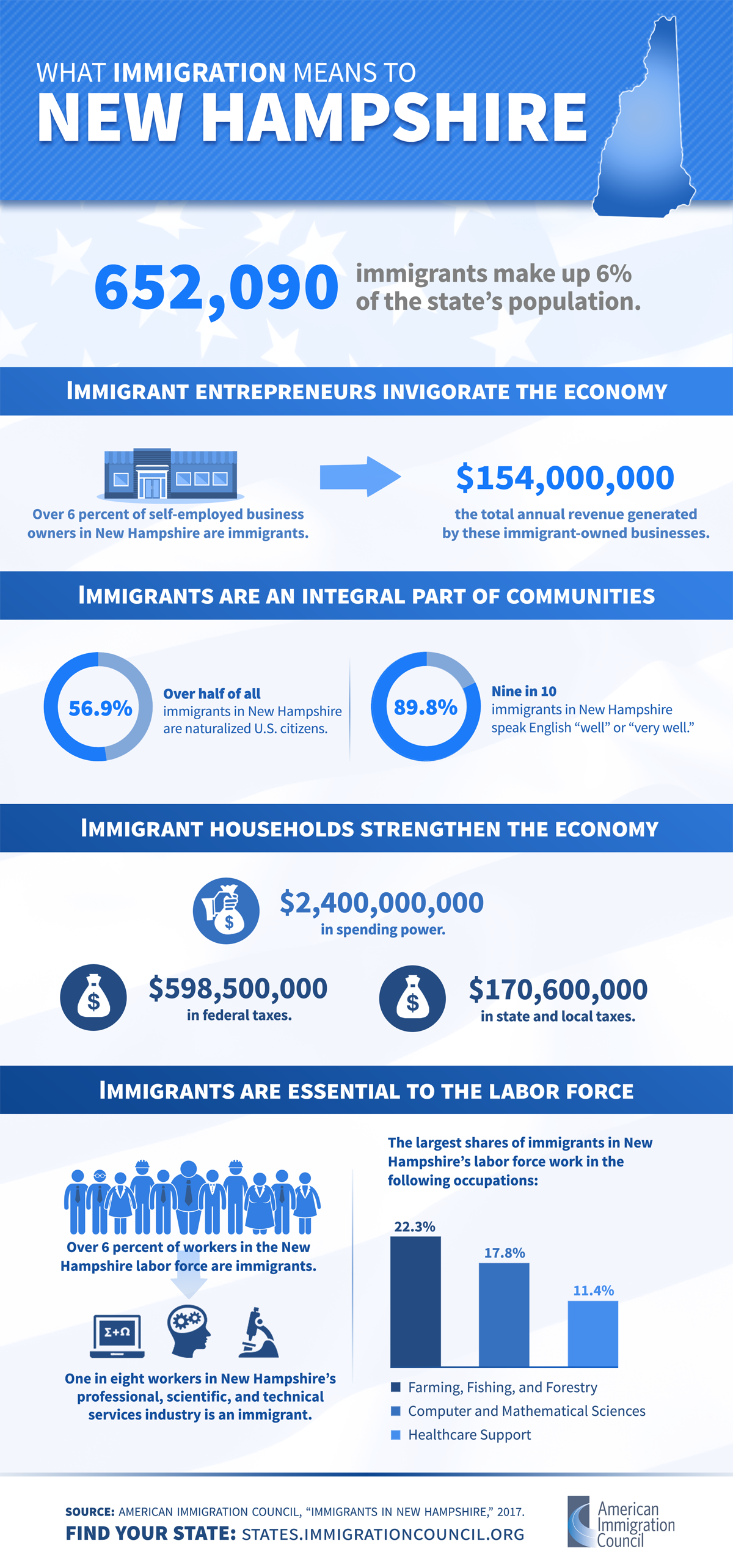

Immigrants In New Hampshire American Immigration Council

New Hampshire Cuts Tax On Rooms Meals To 8 5 Cbs Boston

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

4 Ways To Calculate Sales Tax Wikihow

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

Amazon Sales Tax Everything You Need To Know Sellbrite

New Hampshire Sales Tax Rate 2022